A banking revolution for managing client accounts

Clientquay provides a consolidated, streamlined solution for executing day-to-day client banking services and makes Tom in accounts a profit centre hero

Our bespoke platform negates the need for multiple individual client account logins, time consuming legacy user interactions and the limited functionality of current banking platforms. The current banking mode for client accounts is broken. Reconciliation of client funds is highly ineffcient. Account opening and management is fraught with issues and delays.

Banking services are both financially costly and time consuming and generate no revenue.

Clientquay is powered by Authoripay E-Money Limited which is regulated and authorised by the FCA (Financial Conduct Authority) as an E-Money Institution. Clientquay has been developed in conjunction with leading trust companies, real estate management companies and legal and accounting professionals looking for a better way to manage client funds and payments.

Clientquay leverages the freedom and benefits of PSD2 and Open Banking to give you full autonomy to offer true banking services to your own clients and to earn money from each account.

Using our proprietary technology you can:

24 hour Accounts

Open unlimited UK-based multi-currency physical bank accounts in as little as 24 hours.

Smart Access

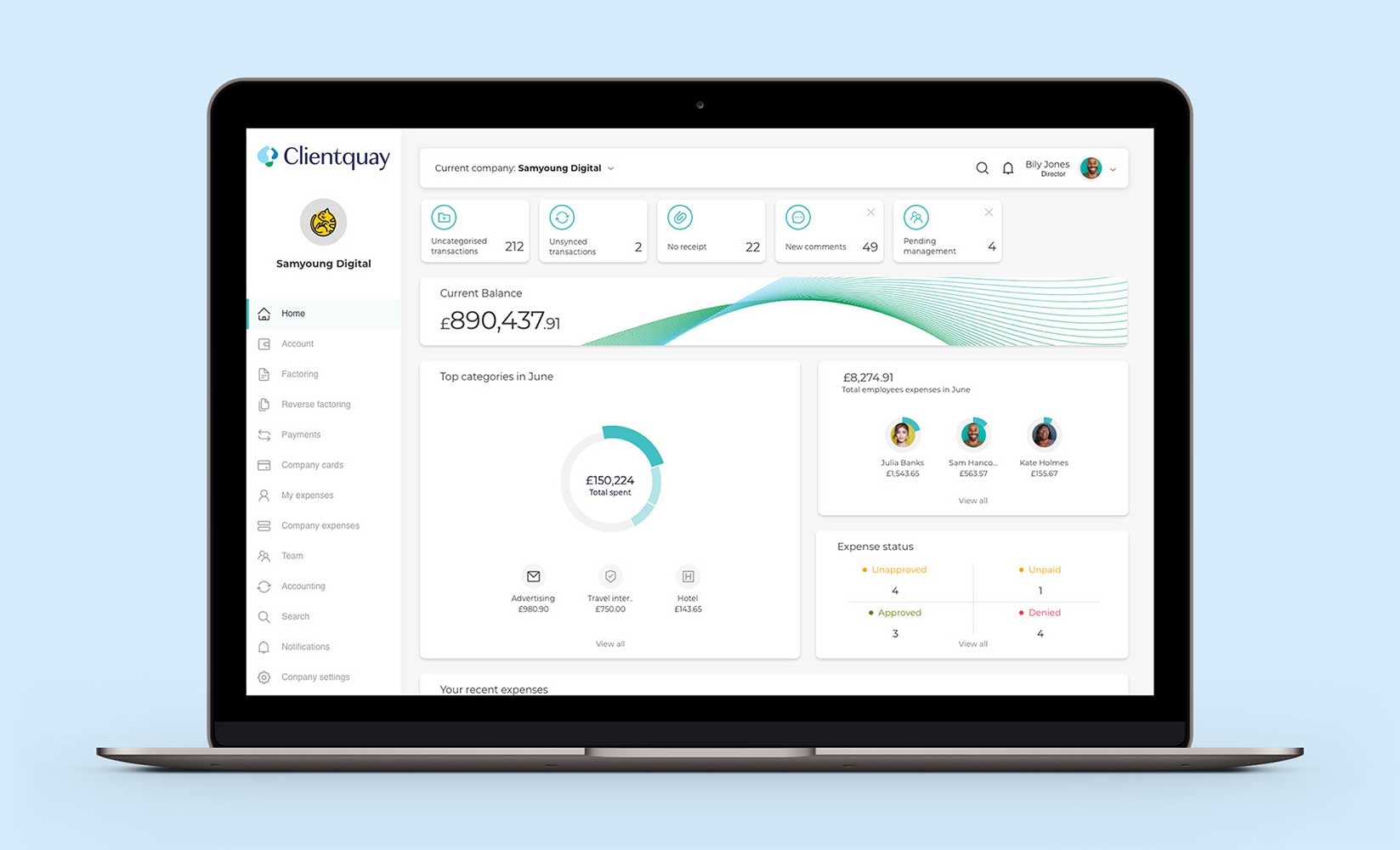

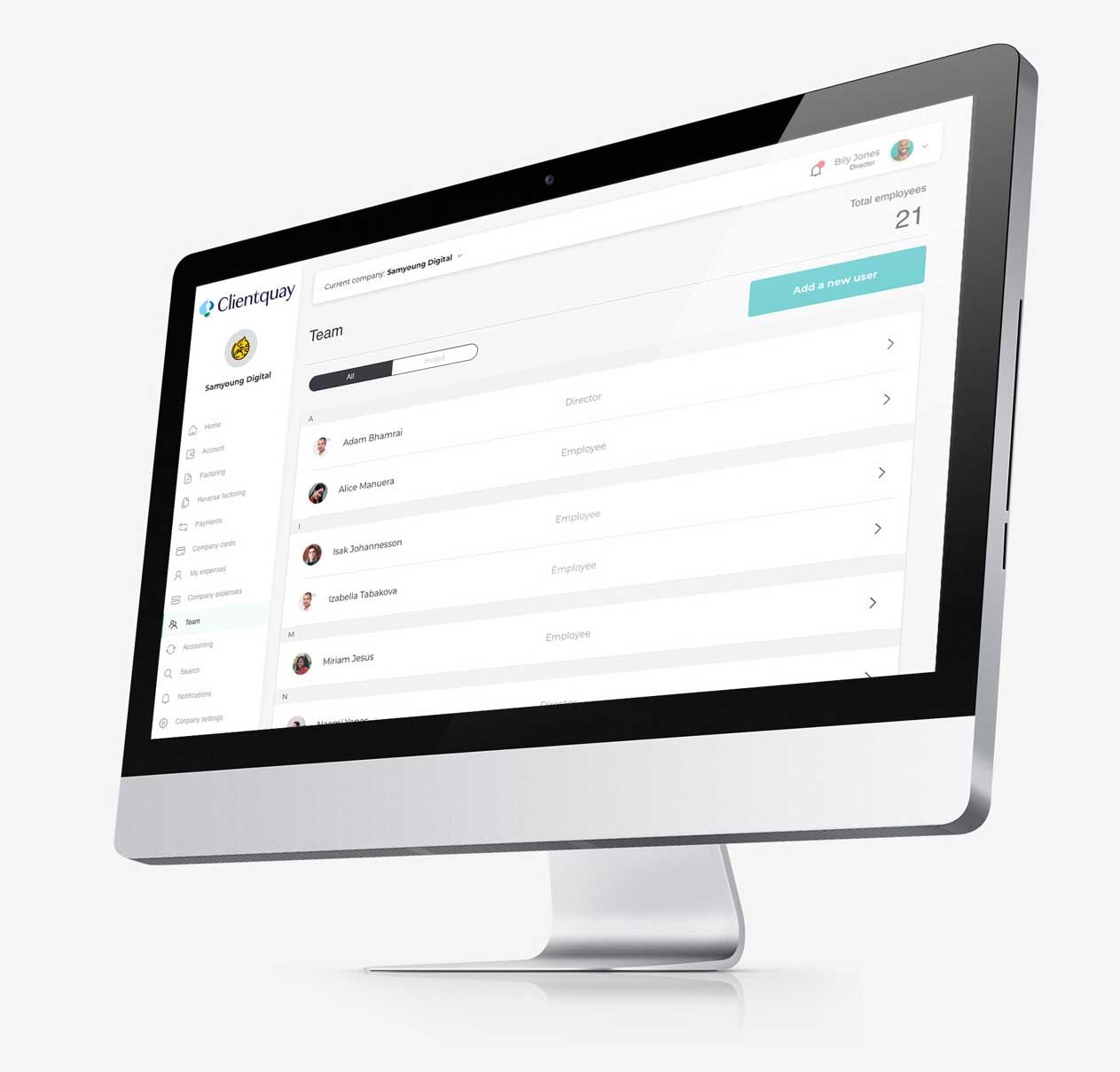

Access all of your client accounts in one place via Clientquay's smart dashboard with real time reconciliation and reporting functionality.

Currency Exchange

Enable client managers, account officers and group finance to execute FX transactions, with access to live price feeds and the ability to tailor spreads for specific clients.

Multi-level authorisation

Assign various levels of authorisation for your outgoing payments.

Peace of mind

All client funds are held in segregated accounts and CASS-compliant accounts with a major UK clearing bank.

Treasury

Ensure a higher proportion of the underlying client assets are identified and captured for short, medium and long-term money-market products.

What is the value?

Tailor and generate new client accounts for difficult user cases

Consolidate your client accounts through one desktop platform

Real-time reconciliation and reporting

Efficient account opening procedure greatly improves the client journey

Significant cost-saving on personnel time and banking fees

Are you ready to be your own bank and control FX, payment and account costs?

- Expedite account opening

- Complex ownership structures

- International directors

- Integrated FX conversions

- Over 42 currency accounts available

- Full compliance and AML suite

- Named client accounts

- Full auto reconciliation

- Advanced reporting functions

- Mulit-factor / level payment authorisation with full encryption

- Each asset has its own physical bank account for payments

- Use accounting as a profit centre

- Reconcile in minutes

Principals and Compliance

We conduct business in line with the rules, principles and ethos of the FCA (Financial Conduct Authority) and having implemented these robust systems and controls we ensure safeguarding of our clients’ assets.

All client funds are protected and segregated by holding client money accounts with one the UK’s most respected clearing banks, Clear.bank, the only bank in the UK not to offer retail banking services. All client funds are held securely at the Bank of England and not used for investment purposes.

These accounts are for our clients to deposit funds and settle payments and are maintained completely independently of our business’ own operational banking arrangements.

Clientquay contains a stringent compliance model integrating market-leading compliance modules, ensuring our clients accept and adhere to the statutory requirements for KYC and CDD in line with FCA regulatory guidelines as well as those of our banking partners.

We maintain muti-layer IT security, proactive traffic filtering with multi-factor authentication and data encryption using Advanced Encryption Standards (AES) to provide secure online access for client managers, account officers and group treasury.